In a move that surprised markets but pleased borrowers, the Bank of England (BoE) has reduced its benchmark interest rate by 0.25 percentage points, bringing it down to 4%—the lowest since early 2023. While some see it as a boost for economic growth, others warn of mixed global consequences, from currency shifts to investor uncertainty.

This is the first cut in over two years, and it comes as inflation slows, economic growth stagnates, and elections loom. Let’s dive into what this decision means for the UK economy, global markets, and the average consumer.

Why Did the BoE Cut Interest Rates?

After months of economic signals pointing to a slowdown, the Bank of England acted to:

-

Stimulate consumer and business borrowing

-

Boost investment and economic activity

-

Counteract rising unemployment

-

Keep pace with global central bank trends

Key Economic Indicators Cited:

-

Inflation fell to 2.4%, close to the BoE’s 2% target

-

GDP growth flatlined in Q2 2025

-

Consumer spending remains weak

-

Real estate and mortgage markets are cooling rapidly

BoE Governor Andrew Bailey stated:

“With inflation moderating and growth at risk, we believe a modest rate cut is the right step to protect stability.”

How Did Markets React?

📉 FTSE 100

Britain’s top stock index dropped 1.1% in early trading, as banking and insurance stocks slid. Financial institutions typically earn more when interest rates are higher.

💷 British Pound

The pound weakened slightly against the U.S. dollar and euro, dropping by 0.4%, as investors anticipated slower capital inflows.

📈 U.S. & Global Markets

-

The Dow Jones rose modestly on hopes the Fed may follow suit

-

European indices like Germany’s DAX and France’s CAC 40 dipped

-

Asian markets remained stable, awaiting further signals

Winners and Losers

✅ Winners:

-

Homebuyers and mortgage holders: Lower rates = cheaper loans

-

Retail and service sectors: Easier credit for spending

-

Exporters: A weaker pound boosts global competitiveness

❌ Losers:

-

Banks and lenders: Reduced lending margins

-

Savers and pensioners: Lower returns on deposits

-

Importers: A weaker pound means costlier foreign goods

What Does It Mean for Inflation?

The BoE insists that the rate cut won’t reignite inflation, citing:

-

Stable energy prices

-

Easing supply chain pressures

-

Slowing wage growth

However, some economists warn of potential risks, especially if:

-

Oil prices rise due to Middle East tensions

-

The weakened pound raises import costs

-

Housing prices surge again due to cheaper credit

Impact on UK Businesses

Real Estate & Construction

Developers welcomed the cut, hoping it will revive stalled projects and attract new buyers. Commercial real estate, however, remains subdued due to post-pandemic work patterns.

Retail & Hospitality

Lower rates could boost discretionary spending, especially ahead of the holiday season.

Manufacturing & Exports

The weaker pound is good news for British manufacturers selling abroad, especially in the automotive and pharmaceuticals sectors.

Global Implications

For the U.S.

With Trump’s new tariffs reshaping global trade, many now wonder whether the U.S. Federal Reserve will also ease its stance. The UK’s move adds pressure, especially as:

-

U.S. inflation holds at 3.1%

-

Consumer spending cools

-

Trump applies pressure for “pro-growth” policies

For the EU

The European Central Bank (ECB) has already signaled a pause in rate hikes, and the BoE’s cut could push it toward a rate reduction later this year.

For Emerging Markets

Lower UK rates may shift capital back into higher-yielding assets in Asia, Africa, and Latin America, providing short-term boosts to those economies.

Political Angle: A Pre-Election Sweetener?

The timing of the rate cut—just months before expected UK elections—has drawn political scrutiny.

The opposition Labour Party claims the cut shows “economic mismanagement,” while the Conservative government argues it demonstrates a “return to financial stability.”

Regardless of party narratives, this move could boost consumer confidence—and voter optimism.

What Experts Are Saying

“This is a bold but necessary step. Growth must take priority now that inflation is largely under control.”

— Dr. Monica Stratton, London School of Economics

“The BoE is walking a tightrope. Too much too soon could undo hard-won inflation gains.”

— David Reid, HSBC Global Markets

What Comes Next?

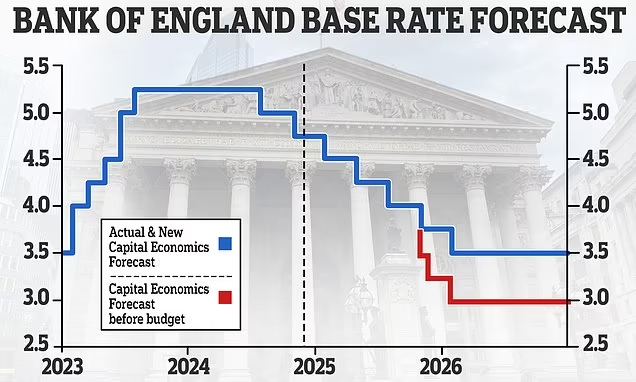

Economists are divided over whether this cut marks the start of a rate-cutting cycle or a one-off precautionary move.

The BoE has left the door open for further reductions, saying decisions will be made “data by data.”

Key factors to watch:

-

Q3 inflation and GDP numbers

-

Global oil and commodity prices

-

Consumer sentiment and retail performance

-

Employment trends

Conclusion

The Bank of England’s surprise rate cut marks a significant shift in UK monetary policy, with wide-ranging impacts from home loans to global equities. While the move may boost short-term economic activity, its long-term effects remain uncertain, especially amid geopolitical volatility and election-year politics.

For now, Britain joins a growing number of economies easing rates to avoid stagnation—and the world is watching closely.

FAQs

Q1: Why did the Bank of England cut rates in August 2025?

To stimulate growth and borrowing amid low inflation and weak GDP performance.

Q2: Will other central banks follow the BoE’s move?

Possibly. The U.S. and EU may consider similar actions if their economies slow further.

Q3: How does this affect regular UK citizens?

Lower rates make mortgages and personal loans cheaper but also reduce savings interest.

Q4: Is inflation under control in the UK?

Yes, inflation has fallen to 2.4%, near the BoE’s 2% target.